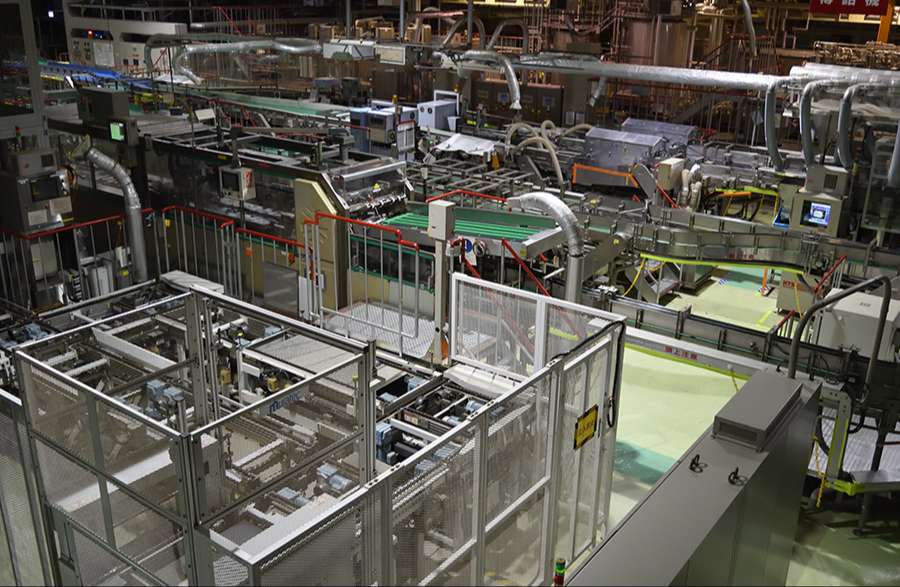

期間工とは一定の期間を決めて工場などで作業に従事する働き方のことです。就業内容は会社によって異なりますが、未経験でも働けたり、給与が高くお金が貯まりやすい、正社員として雇用されることもあり得るとい…

就業内容を基準に期間工の仕事を選んでいくことは、自分に適した就業先を見つけられることに繋がります。残業が少なかったり、興味を持てる仕事に携われたりすることは、長きに亘って就業する上では大切な面もあります。ここでは、就業内容を基準に期間工の仕事を選んでいくことのメリットとデメリット、仕事選びの方法についての解説を行います。